Bitcoin has now surpassed the $100,000 mark after several weeks of fluctuating below this level. This recent surge indicates renewed momentum for the wider crypto market. The asset is currently trading at $100,383, a gain of 3.5% over the last 24 hours.

Bitcoin is still roughly $8.4% below the all-time record high of $109,000, which was reached in January 2025. This shows that there’s room for more upside, should it occur. buying interest persists.

The Buy-Side is under increasing pressure as a key indicator reaches a bullish threshold

CryptoQuant Analyst has reported The Taker Buy/Sell Ratio, which measures the amount of aggressive selling versus buying, has been trending up. Crazzyblockk provided key insights about this trend as well as what it might mean for Bitcoin’s trajectory.

This post is titled “Binance Taker Buy-Sell Ratio – Your Smart Money Radar,” As of today, the ratio stands at 1.131. It suggests that there is a predominant presence market buyers over sellers. The average seven-day rate has increased to 1.045 while the average 30-day rate shows a surge of 12.1%.

This reading indicates a positive sentiment. Although the associated z score of 2.45 may suggest that markets are nearing short-term levels of overboughtness.

Crazzyblockk points out that Binance is one of the best platforms to gauge sentiment because it has a high level of trustworthiness. deep liquidity and trading volume. The platform’s scale provides an accurate reflection of institutional and high-volume trader behavior.

If the taker rate remains above 1.1, and Bitcoin holds the $99,000 mark, then bullish momentum is more likely. If the taker ratio dips below 1,05 it could signal profit-taking or a possible consolidation. Price volatility is also a good opportunity for traders who are looking to profit from market fluctuations.

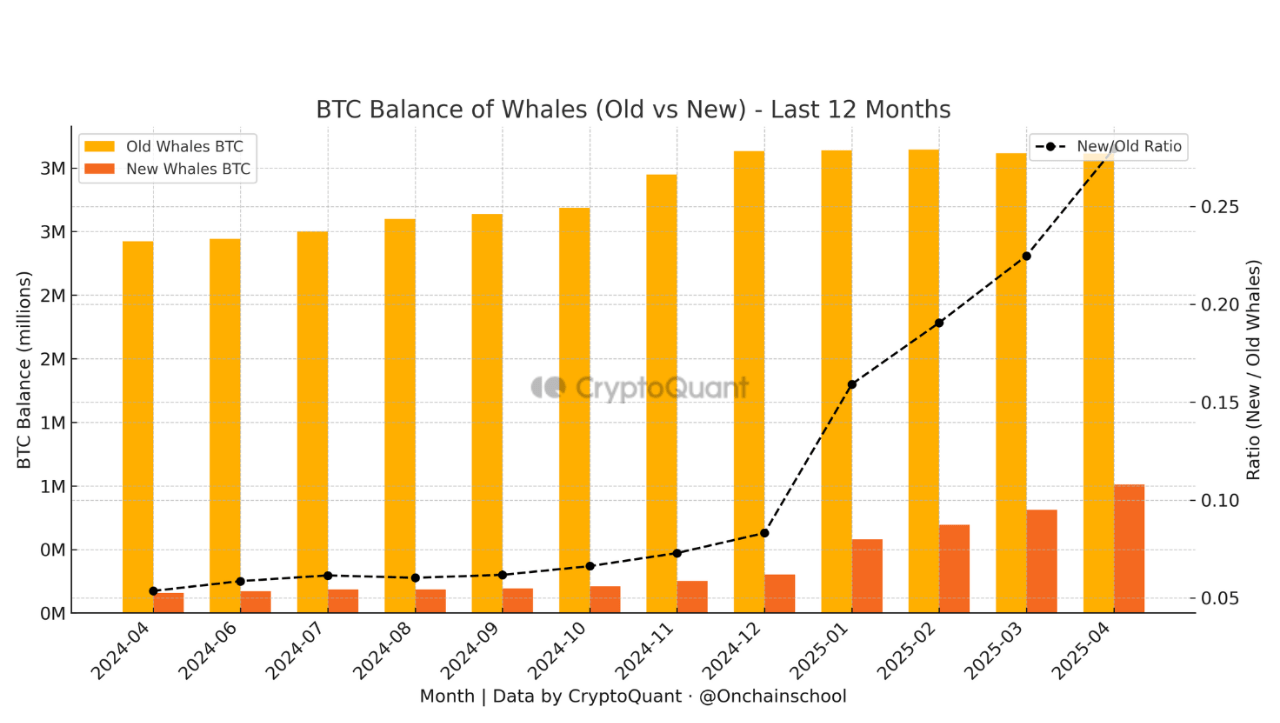

Bitcoin New Whales Reshape Ownership Dynamics by 2025

It is possible to separate the two analysis, CryptoQuant contributor OnChainSchool has observed notable changes in the makeup of Bitcoin’s largest holders. The analyst used on-chain data to identify a significant increase in wallets that held more than 1,000 BTC and coins older than 155, which are typically considered as new whales.

The new-old whale ratio has increased by 75.6% this year from 0.16 onwards to 0.28. increase in their relative presence. These wallets added collectively over 430,000 BTC in their holdings while the older whales lowered their exposure of around 24,000 BTC.

The upward trend of balances indicates that new, higher-valued investors are bringing in capital despite the fact that wallets categorize themselves dynamically. New whales will age out at 155 days.

This coincides with recent events. report of an all-time high recorded in Bitcoin’s realized capThis shows that BTC holders are becoming more confident in the currency.

Bitcoin Breaks Reach All-Time Maximum for Third Consecutive week

“This pattern reflects growing confidence among both Long-Term Holders and Short-Term Holders, who are strengthening their positions as the market shows signs of recovery.” – By @oro_crypto pic.twitter.com/rQoWq1zqHy

— CryptoQuant.com (@cryptoquant_com) May 8, 2025

Charts from TradingView and DALLE were used to create the featured image.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: www.newsbtc.com